Website sections

Editor's Choice:

- Unusual ideas for starting a business

- Cattle breeding - a business plan

- Open a shampoo factory

- Cabinet furniture business plan

- Own business: biohumus production

- Milk Processing Equipment

- How to open a furniture business from scratch: step-by-step instructions and development plan

- How to make a million in breeding worms for fishing

- Production stages of biohumus creation

- What is the case of your watch made of?

Advertising

| Anti-crisis enterprise strategy. Classification of anti-crisis strategies |

|

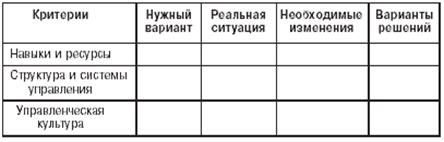

Introduction ……………………………………………………………………… .4 1. The anti-crisis strategy of the enterprise …………………………………………… ... 6 1.1 the crisis of the enterprise: the concept, forms, causes …………………………… 6 1.2. Stages of development and implementation of the anti-crisis strategy of the organization …………………………………………………………………………… ..10 1.3 Types of strategic alternatives to the enterprise ………………………….… 23 2. Anti-crisis strategy of FSUE Karachevsky Plant Elektrodetal ........ 27 2.1 Characteristic of FSUE Karachevsky Plant Elektrodetal ...................... 27 2.2 analysis of the financial and economic activities of the Federal State Unitary Enterprise Karachevskiy Zavod Elektrodetal ………………………………………. 2.3. Analysis of the development and organization of the anti-crisis strategy of the FSUE Karachevsky Plant Elektrodetal ………………………………………… 32 3. Directions for improving the anti-crisis strategy of the Federal State Unitary Enterprise Karachevsky Plant Elektrodetal ………………………………………………………… 35 3.1 Development of proposals for crisis management at the Federal State Unitary Enterprise Karachevsky Plant Elektrodetal 3.2 calculation of the effectiveness of the implementation of measures ...................................... 37 Conclusion …………………………………………………………… ... 41 References …………………………………………………………………… ..42 Appendices ……………………………………………………………………… ..43 Introduction At present, Russia is at the first transitional stage in the development of market relations. A market economy is the result of a long historical process. The tasks at this stage are: achieving the financial and material balance of the national economy; changing stereotypes of creation and behavior; training personnel for the new formation; development of management strategies. Only a little over 10 years have passed since the beginning of radical market transformations in Russia. Naturally, in such a short time, a new management policy in Russia could not objectively appear. Over the years of formation, many problems have accumulated in modern Russia, without which it would be pointless to talk about further integration into the global community of our business. These are the problems: training managers in accordance with international standards; understanding of the essence of management by Russian leaders; inability to make decisions; low professionalism and many more serious problems requiring a lot of attention. Managers must correct the flaws inherent in the domestic market mechanism. The main thing is competitiveness. And we will develop in the global market system. ” This is one of the most serious problems in this transition period. The biggest mistake of modern managers is that very little time is devoted to issues of the general strategy of the enterprise, increasing the competitiveness of the enterprise in the market, creating conditions for the professional training of employees, attracting workers to production management. The purpose of this course work - on the basis of theoretical and practical data to reveal the anti-crisis strategy of the enterprise. The objectives of the course work: 1. To reveal the theoretical issues of crisis management of the enterprise. 2. To analyze the anti-crisis strategy of FSUE Karachevsky Plant Elektrodetal. 3. Suggest ways to improve plant strategy. The Object of study for this course work is the Federal State Unitary Enterprise Karachevskiy Zavod Elektrodetal, since until recently it was in a very difficult situation and for this course work provides ample opportunities in relation to the analysis of the plant management strategy. 1. Anti-crisis strategy of the enterprise 1.1 the crisis of the enterprise: the concept, forms, causes Crisis in the broad sense of the word means a change in an increasing trend of development is decreasing. It is an integral characteristic of a market economy. Based on this promise, any management is anti-crisis, and the content and methods of effective (ordinary) and anti-crisis management are no different. The phases of the crisis differ in content, consequences and necessary measures to eliminate them. The first is a decrease in profitability and profit volumes (crisis in the broad sense). The consequence of this is the deterioration of the financial situation of the enterprise, the reduction of sources and reserves of development. The solution to the problem can lie both in the field of strategic management (strategy review, enterprise restructuring), and tactical (cost reduction, productivity improvement). The second is production loss. The consequence is a decrease in the reserve funds of the enterprise (if there are any, otherwise the third phase will immediately begin). The solution to the problem lies in the field of strategic management and is implemented, as a rule, through enterprise restructuring. The third is the depletion or lack of reserve funds. The company directs part of the working capital to repay losses and thereby switches to a mode of reduced reproduction. Restructuring can no longer be used to solve the problem, since there are no funds for its implementation. We need operational measures to stabilize the financial situation of the enterprise and to raise funds for restructuring. If such measures are not taken or their failure, the crisis goes into the fourth phase. The fourth is insolvency. The enterprise has reached a critical threshold when there is no money to finance even reduced reproduction and (or) to pay on previous obligations. There is a threat of stopping production and (or) bankruptcy. Emergency measures are needed to restore the solvency of the enterprise and maintain the production process. Thus, the third and fourth phases are characterized by non-standard, extreme conditions for the operation of the enterprise, requiring urgent emergency measures. The key point here is the onset or approach of insolvency. It is this situation, in our opinion, that should be the object of crisis management. Let us dwell on the definition of insolvency in more detail. The economic formula of the crisis. It considers the crisis as a direct threat to the survival of the enterprise. There are two aspects - external and internal. External is the ability of the company to mobilize the necessary amount of working capital to fulfill its obligations to creditors - payment and debt servicing. Internal - in the ability to provide the volume of working capital required for business activities. Maintaining the value of working capital at an appropriate level is carried out at the expense of cash and equivalent resources of the enterprise. Thus, in an economic sense, a crisis means a cash shortage to maintain current economic (production) and financial (creditors) working capital needs. The current financial need for working capital (TFE) is defined as the sum of payments payable on the return of debts (including interest on them) at the time of calculation, as well as fines and penalties (in case of late payments) for the planned period. Covered in cash or acceptable to creditors in terms and conditions of offsetting operations. The current economic need for working capital (THP) is the difference between the sum of production and non-production expenses for the planning period, on the one hand, and the volume of production stocks of the enterprise within the limits provided for by the estimate, on the other. In other words, if according to the estimate the monthly consumption of raw materials A is 10 million rubles, while in the warehouse it is only 8 million rubles, then the industrial and technical cost is 2 million rubles. If the raw materials are in stock at 12 million, then there is no need for working capital (there is no "negative" need). The determination of the threshold value of industrial chemical protection, the impossibility of which is critical, depends on the industry and other features of the enterprise. For example, in chemistry and metallurgy there is a minimum technologically permissible production volume, but not for metal processing. The volume of fixed (overhead) costs also cannot serve as an unambiguous criterion for the threshold value of the need for working capital, since it can be adjusted. TKhP is covered in cash or mutually acceptable operations acceptable for the enterprise in terms of content and conditions (i.e. delivery of precisely those goods and services at the right time at an affordable price that would have spent the enterprise’s money). Cash - actually cash and equivalent funds (currently, up to 85% of all payments are carried out by offsetting schemes). It is the amount of cash that is indicative of determining the crisis state of an enterprise. Firstly, each offsetting operation can be quite easily reduced to a monetary value (taking into account cost and time losses). Secondly, specific short-term assets vary greatly in terms of liquidity. Thus, accounts receivable can be hopeless regardless of the formal terms and obligations for its repayment, and stocks of finished products - dead weight. At the same time, their presence does not in any way ensure the real solvency of the enterprise, which is ultimately determined by cash. Thus, the standard logic of economic and financial calculation is not applicable here. When calculating the cash and equivalent funds of the enterprise, two factors are of fundamental importance - the structure of the needs of the enterprise (raw materials, materials, cash) and the time during which these needs must be satisfied. Time factor. Time always has an economic price, but in times of crisis it is calculated on completely different grounds than, say, in the analysis of an investment project. So, an overdue payment in the amount of 500 minimum wages (minimum wages) after 3 months. may result in a collapse of all obligations of the enterprise, even those that must be repaid in a few years. This circumstance determines the price of each day out of these 90, i.e. a kind of "relativistic effect" arises. The time price is taken into account in standard discounting procedures used in financial calculations. These procedures are based on a decrease in the value of future cash flow by a certain amount, which is a power-law function of the length of the expectation of receipt of funds and the discount rate. The latter takes into account inflation and investment risk fees. Its magnitude is a key aspect of the time factor. The economies of developed countries are characterized by discount rates of 5-7%. Another important, including from a psychological point of view, aspect of the time factor in a crisis is that the “falling” enterprise has no future. If after 3 months. if the company turns out to be a defendant in the bankruptcy arbitration process, then any plans become abstract. If the enterprise overcomes the crisis, then it will have a future, and it will be significantly different from the “pre-crisis" one, which must be sacrificed for salvation. 1.2 Stages of development and implementation of anti-crisis strategy of the organization In the development of any organization, there is a likelihood of a crisis. A characteristic feature of a market economy is that crisis situations can arise at all stages of the life cycle of an enterprise (formation, growth, maturity, recession). Short-term crisis situations do not change the essence of the enterprise as a producer of profit, they can be eliminated with the help of operational measures. If the enterprise as a whole is inefficient, the economic crisis takes a protracted nature, up to bankruptcy. The severity of the crisis can be reduced if we take into account its features, recognize in time and see its onset. In this regard, any management should be anti-crisis, that is, built on the basis of the possibility and danger of the crisis. In crisis management, a management strategy is critical. When the inevitability of a crisis, the impossibility of eliminating or slowing it down becomes apparent, the crisis management strategy focuses on the problems of overcoming the crisis, all efforts are focused on ways and means of overcoming it. The search for ways out of the economic crisis is directly related to the elimination of the reasons contributing to its emergence. A thorough analysis of the external and internal environment of the business is carried out, those components that really matter for the organization are highlighted, information is collected and tracked for each component, and the causes of the crisis state are determined on the basis of an assessment of the real situation of the enterprise. Accurate, comprehensive, timely diagnosis of the state of the enterprise is the first step in developing a strategy for crisis management of the enterprise. Analysis of external factors in order to identify the causes of the crisis. When conducting an analysis of the external environment, a large amount of information obtained can only lead to confusion. However, incomplete analysis can distort the true situation. In order to form a clear and understandable picture of the development of the situation, the results obtained must be correctly compared, brought together into a single whole several stages of analysis: · Analysis of the macro environment, which can conditionally be divided into four sectors: political environment, economic environment, social environment, technological environment. · Analysis of the competitive environment in its five main components: customers, suppliers, competitors within the industry, potential new competitors, substitute products. Having received sufficiently extensive information about the external environment, it is possible to synthesize it by the method of creating scripts. Scenarios are a realistic description of what trends may appear in a given industry in the future. Usually, several scenarios are created, on which one or another anti-crisis strategy of the enterprise is then tested. Scenarios make it possible to determine the most important environmental factors that an enterprise must take into account, some of which will be under the direct control of the enterprise (it can either avoid the danger or take advantage of the opportunity). If there are factors beyond the control of the enterprise, the developed anti-crisis strategy should help the enterprise maximize its competitive advantages and at the same time minimize possible losses. Studying the external environment, managers focus on figuring out what threats and opportunities the external environment is fraught with. A fairly popular method, also used to analyze the external environment, is the SWOT method, described in detail in the literature on strategic management. Along with the analysis of the external environment of the enterprise, it is important to conduct an in-depth study of its real state. Armed with this knowledge and a vision of what the enterprise should become in the future, the manager can develop an achievable anti-crisis strategy to make the necessary changes. The weaker the current position of the enterprise, the more thoroughly critical its strategy should undergo. The crisis situation at the enterprise is a sign of either a weak strategy, or its poor implementation, or both. Analyzing the strategy of the enterprise, managers should focus on the following five points. 1. The effectiveness of the current strategy. First you need to try to determine the place of the enterprise among competitors, then the boundaries of competition (market size) and the consumer groups that the company is oriented towards; finally, functional strategies in the field of production, marketing, finance, personnel. Evaluation of each component will give us a clearer picture of the strategy of the enterprise in crisis, and the assessment is carried out on the basis of quantitative indicators. These include the company's market share, market size, profit margin, loan size, sales volume (decreases or increases in relation to the market as a whole), etc. 2. Weaknesses, opportunities and threats to the enterprise. The most convenient and tested way to assess the strategic position of a company is a SWOT analysis. Strength is where the enterprise has excelled. It may consist in skills, work experience, resources, achievements (the best product, perfect technology, best customer service, brand recognition). Weakness is the absence of something important in the functioning of the company, that it does not succeed in comparison with others. When strengths and weaknesses are identified, both lists are carefully examined and evaluated. From the point of view of strategy formation, the strengths of the enterprise are important, since they can be used as the basis of the anti-crisis strategy. If they are not enough, enterprise managers must urgently create the basis on which this strategy is based. At the same time, a successful anti-crisis strategy is aimed at eliminating the weaknesses that contributed to the crisis. Market opportunities and threats also largely determine the anti-crisis strategy of the enterprise. To do this, assess all the capabilities of the industry that can ensure the potential profitability of the enterprise, and threats that adversely affect the enterprise. Opportunities and threats not only affect the state of the enterprise, but also indicate what strategic changes need to be taken. The anti-crisis strategy must take into account prospects that match capabilities and provide protection against threats. An important part of the SWOT analysis is the assessment of the strengths and weaknesses of the enterprise, its capabilities and threats, as well as conclusions about the need for certain strategic changes. 3. The competitiveness of prices and costs of the enterprise. It should be known how the prices and costs of an enterprise are related to the prices and costs of competitors. In this case, a strategic cost analysis is used. The method by which this analysis is carried out is called the “value chain” (Figure 1). Figure 1. - The value chain The value chain reflects the process of creating the value of a product / service and includes various types of activities and profits. The links between these activities can be an important source of enterprise benefits. Each type of activity in this chain is associated with costs and, in turn, with the assets of the enterprise. By correlating production costs and assets with each individual type of activity in the chain, one can estimate the costs of them. In addition, the prices and costs of the enterprise are affected by the activities of suppliers and end users. Managers must have a good understanding of the whole process of value creation, so the value chain of suppliers and end users must be taken into account. The process of determining costs for each type of activity is tedious and complicated, but it makes it possible to better understand the cost structure of the enterprise. In addition, it is necessary to conduct a comparative assessment of the costs of the enterprise and the costs of its competitors for the main activities. Thus, it is possible to identify the best practice of performing a certain type of activity, the most effective way to minimize costs and, based on the analysis obtained, proceed to increase the enterprise's competitiveness in costs. 4. Assessment of the strength of the competitive position of the enterprise. Cost competitiveness assessment of an enterprise is necessary but not sufficient. The strength of the position of the enterprise (how weak or strong) in relation to the main competitors is evaluated by such important indicators as the quality of the goods, financial situation, technological capabilities, the duration of the product cycle. Estimates show the position of the enterprise in comparison in such a way where it is weak and where it is strong, and in relation to which competitor. 5. Identification of the problems that caused the crisis in the enterprise. Managers study all the results of the enterprise at the time of the crisis and determine what to focus on. The data obtained in the study of the crisis state of the enterprise can be systematized and presented in the following form. Without a clear statement of the problems that caused the crisis in the enterprise, without their awareness it is impossible to start developing anti-crisis measures for the enterprise. Either small changes are made to the strategy, or the strategy is completely revised and a new one is being developed. Revision of the mission and goals system of the enterprise. The next, no less important stage of strategic anti-crisis planning is the adjustment of the enterprise mission and goal system. Analysis of the state of the enterprise in crisis. 1. Strategic indicators of the enterprise (market share, sales decreases / increases, profit margins, stock returns, etc.) 2. Internal strengths and weaknesses, external threats and opportunities 3. Competitive variables (product quality / characteristics, reputation / image, production capabilities, technological skills, sales network, marketing, financial situation, costs compared to competitors, etc.) 4. Conclusions about the position of the enterprise compared to competitors 5. The main strategic problems that must be solved by the enterprise The manager coordinating the policy of the enterprise in a crisis situation should concentrate all the information received during the strategic analysis. He should think about whether the enterprise, as part of its previous mission, will be able to overcome the crisis and achieve competitive advantages. If necessary, you need to adjust the mission. A skillfully formulated mission that is accessible to understanding and believed in can be a powerful incentive for changes in strategy. It may include the following: 1. The proclamation of beliefs and values. 2. The types of products or services that the company will sell (or the needs of customers that the company will satisfy). 3. Markets in which the company will operate: o ways to enter the market; o technologies that the company will use; o growth and financing policies. A clearly formulated mission inspires and encourages action, enables employees of the enterprise to show the main prerequisites for the success of the enterprise with various influences on it from the external and internal environment. Then comes the process of adjusting the system of goals (desired results that contribute to overcoming the economic crisis). The manager compares the desired results and research results of factors of the external and internal environment, which limit the achievement of the desired results, and makes changes to the system of goals. Each company has a specific system of goals. They arise as a reflection of the goals of various groups: · Owners of the enterprise; · Employees of the enterprise; · Buyers; · Business partners, · Society as a whole. If the mission is a vision of how the enterprise should be in the future, then the goal system (long-term and short-term goals) is the desired results that correspond to the understanding of the goal. Goals are the starting point of strategic planning, motivation and control systems used in the enterprise. Goals underlie organizational relationships and evaluate the performance of individual workers, units and the organization as a whole. In any organization there are several levels of goals, thus, a hierarchy of goals. Higher-level goals are focused on the long term. They allow managers to weigh the impact of today's decisions on long-term performance. The lower-level goals are focused on the short and medium term and are a means of achieving high-level goals. Short-term goals determine the speed of development of the company, the level of performance indicators and the results that need to be achieved in the near future. The level at which the top management of the enterprise is oriented can be the cause of the crisis. Very often, at Russian enterprises, managers focus on short-term financial goals, neglecting long-term ones. The strategic planning process ends with the formulation by methods of strategic analysis and planning of strategic alternatives for the enterprise to overcome the economic crisis and the choice of strategy. The process of determining the tactics for implementing the selected strategy (operational planning) begins. The following stages are associated with the implementation of the anti-crisis strategy, evaluation and monitoring of results. Implementation of the selected anti-crisis strategy Tactical (operational) measures to overcome the economic crisis can be the following: cost reduction, closure of divisions, staff reduction, reduction in production and sales volumes, active marketing research, increasing product prices, identifying and using internal reserves, modernization, attracting specialists, obtaining loans, strengthening discipline. Strategic and operational planning are interconnected, and it is impossible to engage in one in isolation from the other. Tactical planning should be carried out as part of the chosen strategy. If operational measures to overcome the economic crisis are carried out in isolation from strategic goals, this may lead to a short-term improvement in the financial situation, but it will not allow eliminating the underlying causes of the crisis. The activities of managers in the implementation of the chosen strategy include the following tasks: · Final clarification of the developed anti-crisis strategy and goals, their compliance with each other; · A wider communication of the ideas of the new strategy and the meaning of the goals to employees in order to prepare the ground for enhancing the involvement of employees in the implementation of the anti-crisis strategy; · Bringing resources in line with the ongoing anti-crisis strategy; · Deciding on the organizational structure. When implementing the new strategy, it is necessary to concentrate on how changes will be perceived, what forces will resist, what behavior style should be chosen. Resistance must be minimized or eliminated regardless of the type, nature and content of the change. The enterprise strategy is influenced and imposed by certain restrictions by the existing structure and management system; managerial culture; skills and resources. The reality for many enterprises is such that they do not achieve the optimal combination of structure, culture, and skills necessary for successful activities. The structure of the enterprise largely determines its ability to respond to changes in the external environment. If the enterprise has too rigid an organizational structure, it can become an obstacle to flexible adaptation to new real conditions, slow down the process of innovation and impede a creative approach to solving new problems and tasks. Basically, managers seek to avoid structural changes, which are usually accompanied by confusion, dissatisfaction on the part of staff. As a result, the reorganization is postponed for as long as possible. Management systems facilitate or hinder the implementation of strategies. On the one hand, in enterprises where a bureaucratic management style flourishes, even the most uncomplicated decisions and expenses of lower-level personnel must be approved by a higher-level manager. If a person has been working in a structure of this type for a long time, he is unlikely to want to take on additional responsibility and initiative. Under these conditions, excuses that this is not part of the official duties will be protection against new problems and responsibilities. On the other hand, the lack of systems and documentation can lead to duplication of work already done or loss of information if the employee quits or moves to another place of work within the enterprise. Management culture can be a significant driving force. However, one should not forget that the managerial culture of the enterprise arose as a result of traditions that have a long history and cannot be changed in an instant. Problems may arise if the managerial culture conflicts with the anti-crisis strategy of the enterprise. Different enterprises have their own management style. It may fit well with the firm’s strategy, or it may conflict with it. In some cases, the predominance of one style can lead to problems. It is believed that an autocratic style can only be useful in situations requiring immediate elimination of resistance, when carrying out very important changes. Skills and resources also have a great influence on the anti-crisis strategy, as their proper use is crucial for the success of the enterprise. The manager should maximize the resources of the enterprise and distribute them in such a way as to have the greatest effect. The mechanism of using the resource potential of the enterprise is brought into line with the ongoing anti-crisis strategy. The functional units carrying out the management of the movement of resources within the enterprise should be given new tasks. At the same time, it is necessary to carry out appropriate preparatory work to eliminate resistance from them and to convince the need for effective participation in the implementation of the new strategy. At this stage, managers can compare what is required to implement the anti-crisis strategy with what the company has now. By comparing what is desired with reality, managers can use a point system for evaluating discrepancies. When conducting a comparative analysis, it is important to highlight precisely those points that can fundamentally affect the success of the enterprise. To determine the necessary strategic changes, it is proposed to use a table in which all the evaluated criteria are listed vertically (Figure 2). In the analysis, a wide variety of scales can be used (for example, 0 points may indicate that this criterion does not differ significantly from the ideal option, and 5 points may indicate that the evaluated criterion should be radically revised). The column “Decisions” can be used to describe the specific actions required to achieve the desired options should also be tested before taking anything.

Figure 2. - Assessment of the degree of necessary changes in the strategy of the enterprise. At the stage of implementation of the anti-crisis strategy, senior management may revise the plan for the implementation of the new strategy if new circumstances so require. The last stage of anti-crisis strategic management is the assessment and monitoring of the implementation of the strategy. It aims to find out to what extent the implementation of the strategy leads to the achievement of the goals of the enterprise. In accordance with the foregoing, the scheme of anti-crisis strategic management of the enterprise is as follows (Figure 3).